The division of property following the breakdown of a marriage or de facto relationship can be a stressful prospect. Each party’s assets (property), debts and Superannuation needs to be determined and then divided appropriately, either by agreement or application to the Court. To ensure assets and liabilities are fairly distributed and your interests are well looked after, you will want an experienced family lawyer on your side.

A family law property settlement will consider the property owned by the parties jointly and by each party individually. The property considered includes all assets, liabilities and financial resources and the value of each item established.

- A property settlement considers the following:

- Homes and investment properties,

- Funds held in banks or other financial institutions,

- Shares,

- Businesses, trusts, companies and partnerships,

- Superannuation,

- Mortgages,

- Personal and/or car loans,

- Credit cards, and

- Any other asset or liability held by either party.

It is important to understand that the value given to the assets, liabilities and financial resources is the value of each item at the time a property settlement is entered into, not the date of separation. Furthermore, any item purchased post-separation but prior to a property settlement can be included as part of the assets and liabilities available for distribution between the parties.

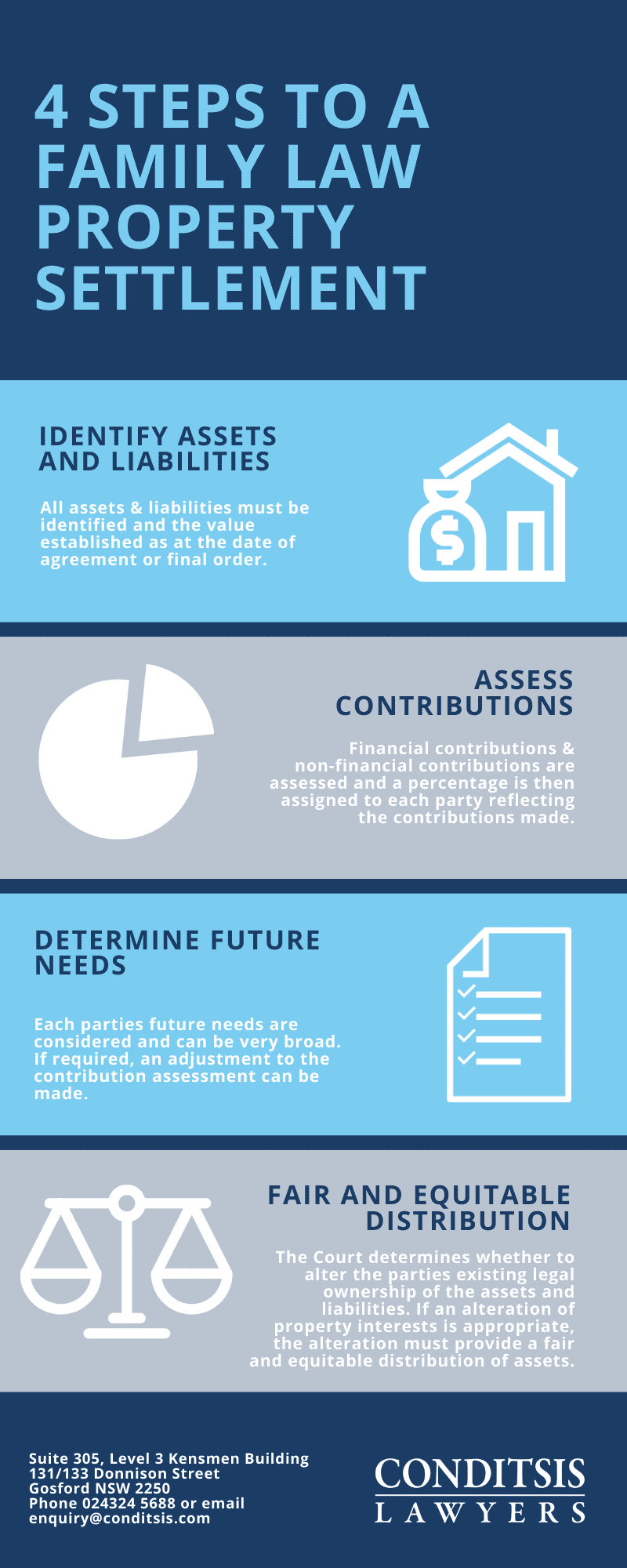

There are four steps to a property settlement as outlined below.